A Legacy of Service.

A Future of Possibility.

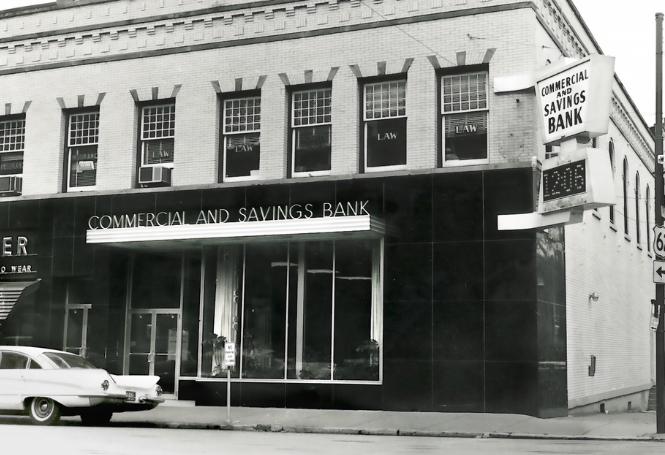

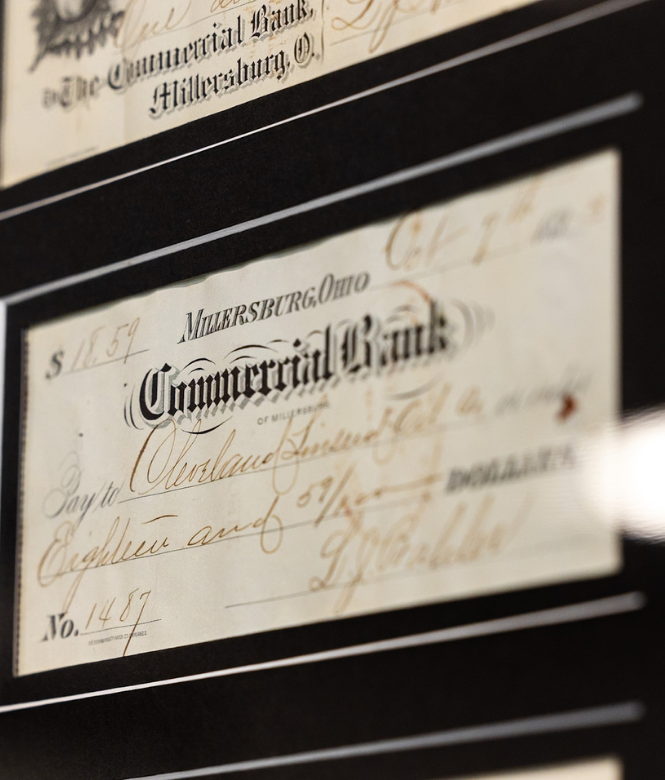

In 1874, John Koch and Robert Long opened a small bank in Millersburg, Ohio. Five years later, it became The Commercial Bank of Millersburg. We still operate under that same charter today.

Over the past 145+ years, we’ve seen change: new locations, expanded services, evolving technology. But our core purpose has stayed the same. We’re here to give you access to tools, guidance, and support that help you move forward. At CSB, banking isn’t just about transactions—it’s about building relationships that strengthen families, businesses, and the communities we call home.

Built on Values. Focused on people.

![]()

Helping Families Thrive

We guide individuals and families as they buy homes, manage daily finances, and plan for the future.![]()

Supporting Local Business

We partner with business owners who create jobs and build strong, local economies.![]()

Investing in Our Communities

From schools to service projects, we support the places and causes that matter most to our customers..png)

- 1874: John Koch and Robert Long form the Bank of Millersburg.

- 1879: Renamed to The Commercial & Savings Bank of Millersburg, establishing the charter still in use today.

- 1911: Official incorporation and move to an office on West Jackson Street.

- 1934–1940: Walnut Creek banking center opens and operates for six years before closing.

- 1967: Walnut Creek branch reopens following strong community petition.

- 1975: New banking center built on South Clay Street in Millersburg to introduce drive-thru service.

- 1979–1989: Operations Center opened with CSB's first computer system. New branches open in Winesburg (1979) and Charm (1987).

- 1988: Sugarcreek Banking Center opens—CSB’s first in Tuscarawas County.

- 1990–1991: Main Office restoration begins. Clinton Commons Banking Center opens inside Rodhe’s IGA.

- 1992: CSB Bancorp, Inc. is formed as the bank holding company. Berlin Banking Center opens.

- 1994: Trust & Financial Services department is launched, adding brokerage and benefit services.

- 1998: Shreve Banking Center opens—CSB’s first in Wayne County.

- 1999: New Operations Center built in Millersburg to support technology and staffing growth.

- 2007–2008: CSB enters Orrville market (2007) and adds locations in Gnadenhutten, New Philadelphia, and North Canton through the acquisition of Indian Village Bancorp, Inc. (2008).

- 2011: Two new locations added in Wooster.

- 2016: Downtown Wooster location moves to a new space.

- 2017: New downtown Orrville Banking Center built, consolidating previous locations.

- 2019: Wooster location relocates to a newly constructed, permanent facility.

- 2020: Entered Bolivar market and surpassed $1 billion in assets.

- 2021: North Canton Banking Center expands into a new location to better serve customers.

- 2023: Loan Production Office opened in Medina County, extending reach into a new market.

What Banking with CSB Means

With CSB, you get more than accounts and applications. You get real support from a team that knows your name and cares about your goals.

Here's some words we use to describe relationship banking:

Enduring Greatness

That’s our vision. It means staying strong for the long haul: financially, culturally, and in how we serve.

We believe the future of banking isn’t about being the biggest. It’s about being there when it counts, with tools that work and people who care.

We serve communities where relationships still matter—where trust is earned through consistency, and where banking is personal. If you live in one of those communities, you’ve probably already felt the CSB difference.